Ghana’s petroleum sector recorded a revenue shortfall of $470.43 million in the first half of 2025, the country’s Public Interest and Accountability Committee (PIAC) has revealed.

PIAC made this known in its latest Semi-Annual Report on petroleum revenue utilization.

According to the report, an amount of $370.34 million was deposited into Ghana’s Petroleum Hold Fund (PHF) during the first half of this year, down from $840.77 million recorded during the same period in 2024.

The report says the $370.34 million represents a drop of 56% year-on-year in half one of this year.

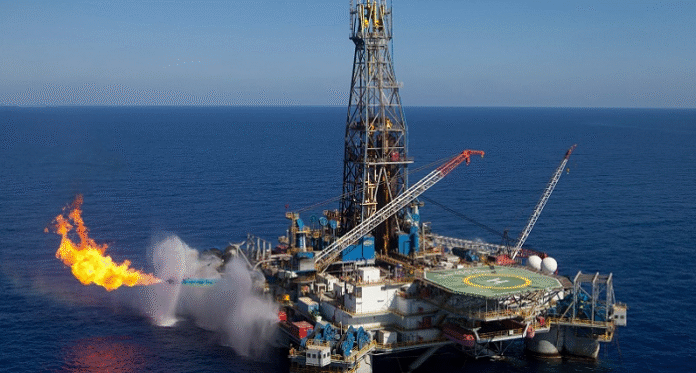

PIAC says in the report that the sharp drop in the petroleum revenue was due to lower crude oil liftings and a fall in global oil prices which it says reduced export revenues from Ghana’s three oil-producing fields namely Jubilee, TEN, and Sankofa-Gye Nyame (SGN).

According to the report, the 2025 first-half petroleum inflows came from Corporate Income Taxes (CIT), Carried and Additional Participating Interest (CAPI), Royalties, Surface Rentals, and Interest on the PHF.

Breakdown of receipts:

Of the total receipts:

• CAPI contributed US$178.48 million (48%)

• CIT generated US$148.75 million (40%)

• Royalties yielded US$40.15 million (10.8%)

• Interest on the PHF amounted to US$2.10 million

• Surface Rentals brought in US$0.86 million, less than 1% of total inflows.

Since the start of oil production in 2011, Ghana’s cumulative petroleum revenue has reached US$11.58 billion, highlighting the sector’s continued importance to the economy despite recent volatility.