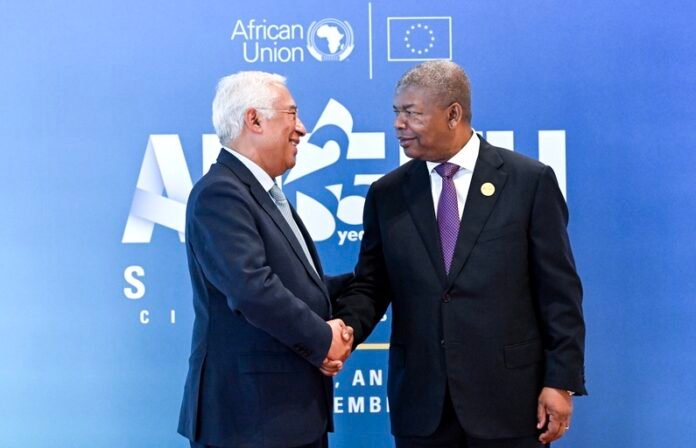

African Union (AU) Chair and Angolan President João Lourenço urged European and international partners on Monday to support major reforms to global debt and financing systems, arguing that current mechanisms are failing African economies facing rising debt pressures.

Speaking at the opening of an AU–European Union summit in Luanda, Lourenço said Africa needs “fairer and more efficient” restructuring tools to prevent countries from sinking deeper into debt distress as they try to invest in health, infrastructure, and economic growth. A significant number of African states are now considered at high risk of default due to mounting repayment obligations and limited access to affordable credit.

Lourenço criticised the shortcomings of the G20’s Common Framework—an initiative launched during the COVID-19 pandemic to speed up debt restructuring for low-income countries. Only a handful of countries have entered the process, and cases such as Zambia, Ghana and Ethiopia have taken years to progress. Although G20 leaders meeting in South Africa last weekend pledged to strengthen the system, African leaders remain concerned about delays and lack of transparency.

“International lenders must rethink how they engage with Africa,” Lourenço said. “We need financing conditions that allow long-term development rather than trapping our nations in cycles of unsustainable debt.”

United Nations Secretary-General António Guterres echoed the call for reforms, saying the current global financial architecture is outdated and disproportionately disadvantages developing economies. He urged greater African representation in global financial institutions and emphasised the need to break what he described as a “crushing debt cycle.”

South Africa, during its G20 presidency this year, convened a panel of African economists who recommended creating new refinancing tools tailored to low-income countries. The panel argued that the Common Framework focuses too heavily on rescheduling payments instead of offering relief that supports long-term stability.

Rising concerns in countries such as Senegal, Mozambique, and others experiencing growing debt vulnerabilities have renewed attention on the limitations of current international debt mechanisms, intensifying calls for a more responsive and inclusive global financial system.

Source:Africa Publicity