Botswana has taken steps to diversify its economy by launching a new sovereign wealth fund.

The fund is expected to diversify the country’s economy beyong diamonds.

It also seeks to create new jobs, especially for young graduates as well as play a more active role in managing state-owned companies.

Botswana has run the central bank-managed Pula Fund for more than three decades to save mineral revenues and stabilise public finances. But repeated budget deficits have eroded those buffers, prompting a separate vehicle with a different mandate.

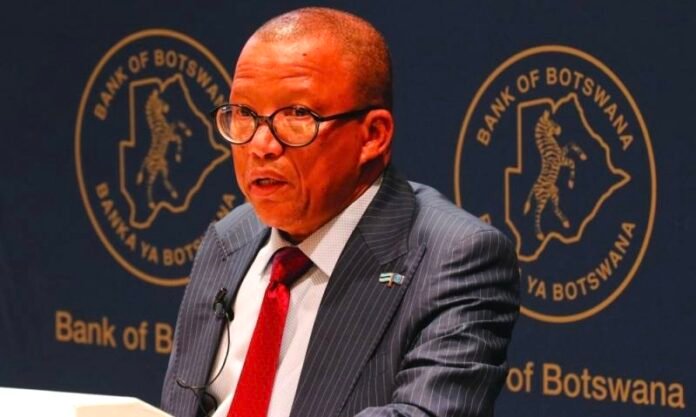

Board chair of the central bank of Botswana, Farouk Gumel, told journalists at a news conference that

“The Pula Fund is a liquidity stabilisation fund; it takes cash and keeps it for a rainy day. This sovereign wealth fund will not be only about stabilisation — it’s about growth,” adding that “We are not only going to be managing cash, but also assets, including some state-owned entities.”

Deputy board chair Emma Peloetletse says withdrawals would be limited to investment returns rather than capital and that the fund could invest both domestically and abroad. Officials said the inaugural board blends local and international experts.

Source:Africa Publicity