By: Isaac Christopher Lubogo

A Discourse on the Origins, Imperatives, and Global Benchmarks for Eco-Friendly Currency Notes

I. ORIGINS: THE HISTORICAL CONTEXT OF UGANDA’S CURRENCY DESIGN AND MATERIAL

Since the introduction of the Uganda shilling (UGX) in 1966, replacing the East African shilling, Uganda’s banknotes have largely followed the conventional model of cotton-based paper currency. Traditionally, currency notes have been made of cotton fiber blended with linen and synthetic threads—durable to a degree, but not impervious to wear, fraud, or environmental degradation.

Uganda’s central bank has historically focused on enhancing security features (e.g., holograms, watermarks, and UV threads) more than material innovation. Environmental considerations—such as the carbon footprint of production, the degradation timeline, and chemical processing—were not priorities during the formative years of currency development.

Yet, as the world shifted toward sustainable finance, and in the wake of growing global consensus around green economies, Uganda’s currency material remains in ecological limbo.

II. THE CASE FOR ECO-FRIENDLY CURRENCY: UGANDA’S ENVIRONMENTAL AND ECONOMIC REALITY

🌿 1. Currency as a Public Resource and Environmental Pollutant

The average Ugandan banknote has a lifespan of less than 18 months for low denominations (like UGX 1,000 or 2,000). Once torn, soiled, or damaged, these notes are incinerated or disposed of—contributing to solid waste pollution and toxic emissions, especially where disposal protocols are weak.

As Uganda grapples with climate vulnerability, rapid deforestation, and plastic mismanagement, ignoring the ecological burden of currency printing is no longer viable. Currency, after all, is mass-produced—and if printed irresponsibly, becomes mass destruction.

💡 2. Cost-Efficiency and Longevity of Polymer Notes

A compelling justification for eco-transition lies in polymer notes, which are more durable, recyclable, and cost-effective in the long term. Though their initial printing cost is higher, polymer notes last 2.5 to 4 times longer than paper notes, reducing replacement frequency, environmental strain, and printing costs over time.

For a country like Uganda, where lower denominations change hands frequently (especially in rural and informal sectors), the reduction in circulation wear would yield huge financial and ecological dividends.

III. GLOBAL BEST PRACTICES: LESSONS FROM THE WORLD’S GREEN CURRENCIES

🇦🇺 Australia: Pioneer of Polymer

In 1988, Australia became the first country to issue polymer notes, engineered by the CSIRO to combat counterfeiting and environmental degradation. Today, all Australian notes are 100% recyclable, water-resistant, and emit less greenhouse gas across their lifecycle.

🇨🇦 Canada: Durable and Transparent

Canada followed suit in 2011 with its “Frontiers” series, emphasizing longevity, recyclability, and security. The polymer notes survive cold, water, and wear, and are eventually transformed into plastic pellets for reuse.

🇳🇬 Nigeria: Africa’s Cautious Embrace

Closer to home, Nigeria issued polymer notes for lower denominations (₦5, ₦10, ₦20, and ₦50). Though not universally adopted across all denominations, it signaled an Afro-centric possibility: that polymer technology is viable on the continent.

Uganda must learn from this—especially in balancing public perception (since polymer feels different) with environmental necessity.

IV. CURRENT CHALLENGES AND OPPORTUNITIES FOR UGANDA

⚖️ Challenges

Initial Cost and Technology Transfer: Uganda lacks indigenous polymer printing capacity and would need partnerships or licensing from international firms.

Public Acceptance: The tactile feel and stiffness of polymer can initially seem foreign and provoke skepticism.

Transition Logistics: Gradual phase-outs, currency recall plans, and rural sensitization require a robust Central Bank communication strategy.

🌍 Opportunities

National Development Plans: Uganda Vision 2040 and the National Development Plan III already prioritize sustainability and environmental integration—currency reform is a natural extension.

EAC & AfCFTA Synergies: As regional economies integrate, a shift to durable, standardized eco-currencies would ease cross-border trade and align with the Green Growth Agenda of the African Union.

Youth and Environmental Policy Alignment: Eco-friendly currency is not just a fiscal decision; it’s a symbol of national consciousness, especially for Uganda’s young, climate-aware population.

V. RECOMMENDATIONS: PATHWAY TO GREEN CURRENCY

1. Initiate a Feasibility Study through Bank of Uganda, engaging environmental economists, polymer technologists, and monetary historians.

2. Pilot Polymer Notes in high-circulation, low-value denominations like UGX 1,000 and UGX 2,000.

3. Public Education Campaigns to demystify polymer notes and emphasize their sustainability advantages.

4. Collaborate with Global Currency Printers like Note Printing Australia or De La Rue to transfer skills and potentially build local capacity.

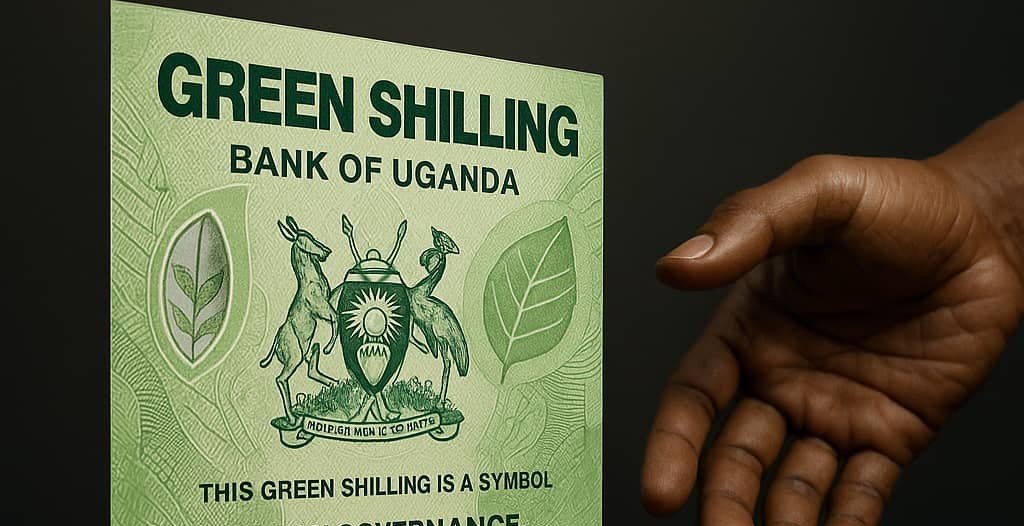

5. Green Branding: Introduce eco-friendly notes under a “Green Shilling Initiative”, linking it to Uganda’s climate commitments under the Paris Agreement.

VI. CONCLUSION: CURRENCY AS NATIONAL ETHOS

Money is not just an economic instrument; it is a material embodiment of a nation’s identity, values, and vision. In an age where Uganda is increasingly vulnerable to environmental shocks, the continued use of outdated, waste-generating currency formats contradicts both global and national development ideals.

Uganda must transition to an eco-friendly currency not only for practical or economic reasons, but as a bold civic declaration: that even in the smallest, most ordinary things — like the note in your pocket — the country chooses sustainability, responsibility, and progress.

> “If we must print money, let it be with clean hands and a green conscience.”

— Lubogo School of Thought

PART TWO : ” GREEN SHILLING ” IN FIGHT AGAINST CORRUPTION

Let us analyse how Uganda can use this Green Shilling Campaign—a transition to eco-friendly, polymer-based currency—can strategically contribute to the fight against corruption, both symbolically and operationally. I also benchmark it with relevant international practices to justify its potential as a tool in Uganda’s anti-corruption arsenal.

The Green Shilling vs. The Greedy Hand

Eco-Friendly Currency as a Strategic Lever in Uganda’s Fight Against Corruption

I. THE PHILOSOPHICAL PREMISE: SYMBOLISM AS A STRATEGY

In a country like Uganda—where corruption is systemic, normalized, and deeply entrenched in both high and low places—even symbolic reforms can provoke cultural shifts. Currency is more than a medium of exchange; it is the tangible symbol of trust between the state and the citizen. Therefore, reforming currency is a strategic act of re-legitimization—especially when the material, design, and message signal ethical rebirth.

The Green Shilling, if properly framed, becomes not just a shift in material but a shift in national moral narrative: from waste to sustainability, from opacity to transparency, from decay to accountability.

> “Corruption feeds on invisibility, secrecy, and symbols that no longer command respect. A currency that is modern, traceable, and responsibly produced becomes both a psychological and systemic weapon.”

— Prof. Patrick Loch Otieno Lumumba (paraphrased)

II. OPERATIONAL CONTRIBUTIONS: HOW ECO-CURRENCY FIGHTS CORRUPTION

🔍 1. Enhanced Traceability and Anti-Counterfeiting

Polymer notes, due to their design complexity, drastically reduce counterfeiting, which is a hidden but potent enabler of underground corruption economies—especially during election seasons and procurement deals.

Uganda has previously experienced fake cash in circulation (notably during election campaigns).

Polymer notes incorporate transparent windows, tactile features, micro-optics, and machine-readable security codes that are harder to replicate and easier to audit.

In Kenya, following the 2019 demonetization of the Ksh 1,000 note (due to counterfeiting and money laundering), polymer-based notes were introduced as part of an anti-corruption drive.

> Benchmark: The Reserve Bank of India and the Central Bank of Nigeria used currency redesign and security upgrades to flush out hoarded, untraceable cash—forcing corrupt actors to declare or destroy stashes.

🏦 2. Reduced Frequency of Note Replacement = Reduced Procurement Fraud

Uganda loses billions through inflated or manipulated public procurement contracts, including those involving Bank of Uganda and external printing firms. Paper notes wear out faster, necessitating more frequent procurement cycles—each one an opportunity for graft.

With polymer notes, the lifespan increases 2.5 to 4 times, reducing:

Printing contracts

Foreign exchange costs

“Facilitation fees” paid to offshore agents or insiders

Fewer procurement cycles = fewer corruption windows.

> Case in Point: The scandal involving the 2019 “BoU currency printing saga” exposed weaknesses in oversight, as extra cargo was allegedly smuggled on a chartered flight. A shift to durable, serialized polymer notes could limit such logistical lapses.

📉 3. A Tool for Currency Recalibration or Demonetization

Transitioning to polymer gives the government a credible policy platform to phase out old notes—which can strategically target stashed illicit funds. A controlled transition could:

Set deadlines for exchange of old (paper) notes

Flush out undeclared wealth hidden in bulk cash

Strengthen Know-Your-Customer (KYC) frameworks in the exchange process

> Benchmark: In 2016, India demonetized its ₹500 and ₹1,000 notes, compelling citizens to declare large cash holdings. Though controversial, it exposed enormous volumes of black money. Uganda could do this with more finesse—under the banner of sustainability and transparency.

🧠 4. Psychological Shift: Aligning Currency with Ethical Governance

Money is not just economic; it is moral. When citizens see the state investing in responsible, ethical production of the very symbol they hold daily, it reasserts a commitment to integrity. Imagine this message on the new note:

> “This Green Shilling is a symbol of clean governance, accountability, and our shared future.”

School children will ask questions.

Market vendors will reflect on its meaning.

Corrupt actors will know: “Big Brother is watching.”

This psychological reengineering is soft power, but in a moral economy, it is real power.

III. RISKS AND SAFEGUARDS

Of course, a note alone cannot end corruption. If not accompanied by institutional reforms, the Green Shilling risks being dismissed as “greenwashing.”

Key safeguards include:

Transparent tendering for polymer suppliers (avoid a repeat of BoU’s 2019 saga).

Parliamentary oversight and budget scrutiny during transition.

A public campaign led by trusted figures: civil society, clergy, educators—not just politicians.

IV. FINAL REFLECTION: IS THIS ENOUGH?

The Green Shilling won’t arrest corrupt ministers, but it will:

Make it harder to hide dirty money.

Reduce backdoor procurement fraud.

Send a moral signal to a jaded public.

Create a new public conversation linking value to virtue.

> As John Locke once wrote, “Wherever law ends, tyranny begins.” But in Uganda, we might add: wherever money is printed irresponsibly, corruption begins.

The Green Shilling therefore becomes part of a multi-pronged reform ecosystem:

🔹 Digital surveillance (URA & FIU)

🔹 Legislative tightening (Leadership Code Act)

🔹 Civic reawakening (youth & schools)

🔹 Symbolic rebranding (Green Shilling)

V. CONCLUSION: FROM POLYMER TO POLICY

The Green Shilling is not merely about material change—it is a conceptual re-alignment of Uganda’s moral economy. It is about holding a note in your hand and believing that what it represents has been earned cleanly, printed justly, and guarded faithfully.

Uganda can benchmark this innovation as part of an “Anti-Corruption by Design” framework—where policy, material innovation, and moral leadership converge.